Purpose of Program

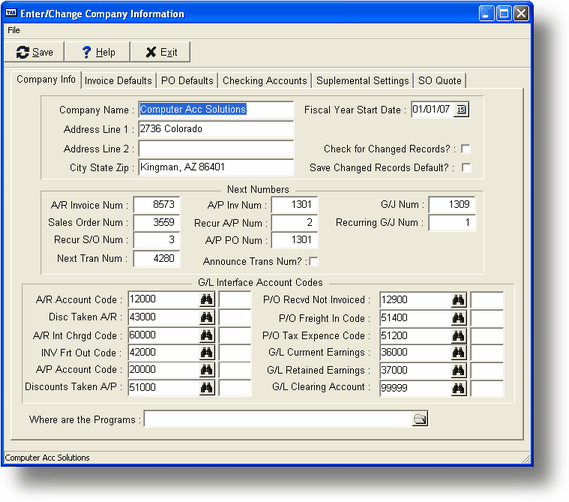

Use this option to enter or change general company information and system-wide interface accounts. The entry screen for this option is displayed below.

Field Descriptions

Company name

Your company name. This is a 25 character alphanumeric field which you will see displayed at the bottom of the main menu. You can use upper and lower case characters.

Address Line 1

Your company address. This is a 25 character alphanumeric field. You can use upper and lower case characters.

Address Line 2

Additional address information. This is a 25 character alphanumeric field. You can use upper and lower case characters.

City, State, Zip

The final lines of your address. This is a 25 character alphanumeric field.

Fiscal Year Start Date

If you are on a calendar year, this would be 1/01/95, 1/01/96, etc. If you are on a fiscal year, then this is the start of your year. This is automatically updated when you run SY-K, Year End Routines.

![]() YOU ARE NOT ALLOWED TO CHANGE THIS FIELD VALUE ONCE IT IS ENTERED ORIGINALLY. IT IS DISPLAYED HERE FOR INFORMATION ONLY. ALWAYS RUN YEAR END ROUTINES AT THE END OF YOUR YEAR TO CHANGE THIS TO THE NEXT YEAR DATE. YOU WILL BE ABLE TO POST TRANSACTIONS INTO THE PRIOR YEAR AS LONG AS NECESSARY, RECLOSING AS MANY TIMES AS NECESSARY (SY-L, Reclose Prior Years).

YOU ARE NOT ALLOWED TO CHANGE THIS FIELD VALUE ONCE IT IS ENTERED ORIGINALLY. IT IS DISPLAYED HERE FOR INFORMATION ONLY. ALWAYS RUN YEAR END ROUTINES AT THE END OF YOUR YEAR TO CHANGE THIS TO THE NEXT YEAR DATE. YOU WILL BE ABLE TO POST TRANSACTIONS INTO THE PRIOR YEAR AS LONG AS NECESSARY, RECLOSING AS MANY TIMES AS NECESSARY (SY-L, Reclose Prior Years).

Check for Chgs in Records

If you enter Y here the program will alert you to changes you have made in Customers, Vendors, Inventory Items and G/L Accounts, when you are in the appropriate maintenance program, and have not saved the changed record. This will help keep you from making changes to a record and then losing those changes accidentally. If a record has been changed the program will display a message to that effect and will allow you to update the record before you continue.

Save Chgd Record Default

If you enter Y in the Check for Chgs in Records field you will also be able to set here what the default answer should be to the update record question should changes be made that weren't saved.

The sales order, purchase order, and invoice numbers described below are automatically reset to 1 when you run BKCLRDAT as part of system startup. After running BKCLRDAT, you can enter the number that correctly represents the next item here.

Next A/R Invoice Number

The number of the next Accounts Receivable invoice. When setting up Advanced Accounting for the first time, this number will have a default value of 1. You can change this number at setup time; otherwise, the number is incremented when the invoice is printed.

Next Sales Order Number

The next number to be assigned when a new sales order is created in SO-A, Enter Sales Orders. This number is incremented through the sales order system.

Next Recurring S/O Number

Advanced Accounting allows you to set up "templates" of sales orders that are sent on a regular basis. If you have set up recurring sales orders in program SO-I, Recurring Sales Order Entry, you can create them at the appropriate time using program SO-J, Generate Recurring Sales Orders. Each template created will increment the recurring sales order number displayed here.

Next A/P Invoice Num

The number to be assigned to the next A/P invoice created when transferring payroll taxes to A/P, when transferring sales taxes to A/P, and when invoicing receipt of goods in PO-D, Receive Purchase Orders.

Next Recurring A/P Number

You can set up a "template" for A/P vouchers that you create on a regular basis (e.g., rent or utilities) using AP-M, Enter Recurring Vouchers. When you create a new template for a recurring voucher, this number will automatically be assigned and then incremented for the next template.

Next A/P P/O Num

The number of the next Accounts Payable Purchase Order. This number is incremented as you create purchase orders in PO-A, Enter Purchase Orders.

Next G/J Number

The next G/J batch number. This is used as an internal transaction count.

Next Recurring G/J Number

You can set up a "template" for recurring general journal transactions such as depreciation or service charges. When you create a new template for a recurring general journal type, this number will be assigned and then incremented for the next template.

Next Trans Num

Each time a transaction is posted to the G/L a unique transaction number is assigned. This number can be displayed on the screen at posting (see Announce Trans Num next) and can be used for tying paper invoices, vouchers, etc to the actual transaction. Once this number is assigned and the posting process has started you should never change this number to less than it currently is.

Announce Trans Num

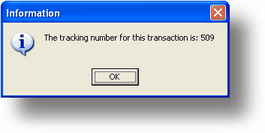

In many Advanced Accounting 7 programs the transaction number (see above) can be displayed at runtime. Two things happen at that time. First the transaction number is displayed so that you can then write the number on the item you're using as the input for the transaction thereby tying the paper to the internal numbers. The second is a message can be added to the transaction that will print in the G/L (GL-D and GL-E). To have both of these happen at runtime you need to enter Y here. If you do a dialog box similar to the following will be displayed to display the transaction number:

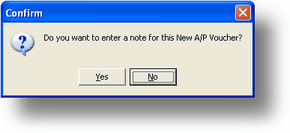

And, a dialog box similar to the following will be displayed immediately after to allow you to enter a note if desired:

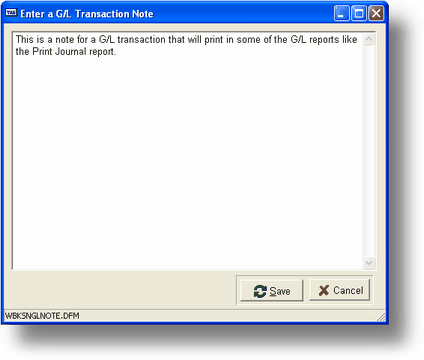

If you answer Yes to this dialog box the following screen will be displayed, allowing you to enter the note.

![]() Not all posting routines will announce the transaction number regardless of what you enter here. This includes AP-F, PR-D, etc. These are always programs that post multiple transactions to the G/L at the same time. However, the transaction number is being created for each individual posting so that it is still available in GL-D and GL-E.

Not all posting routines will announce the transaction number regardless of what you enter here. This includes AP-F, PR-D, etc. These are always programs that post multiple transactions to the G/L at the same time. However, the transaction number is being created for each individual posting so that it is still available in GL-D and GL-E.

G/L Interface Account Codes

None of the account code fields described below should be left blank. If you do not plan to use a particular account, you should enter the same account number you will use as your G/L clearing account (assigned at the bottom of this screen). These are the default accounts to which your transactions will be posted.

![]() All account codes you enter can also include a department code. See program SY-F, Create G/L Department, for a discussion of department codes.

All account codes you enter can also include a department code. See program SY-F, Create G/L Department, for a discussion of department codes.

Accounts Receivable Code (Asset Account)

The account code for your Accounts Receivable G/L account. When you create customer invoices, the amount of the invoice will post here.

Discounts Taken A/R (Expense or Contra-Income Account)

If you offer discount terms on your receivables, the system will post those discounts to this account.

A/R Interest Chrgd Code (Income Account)

If you charge your customers interest on overdue invoices, the system will post the interest to this account.

Invoice Freight Out Code (Income Account)

The account you charge for shipping orders to customers. Freight amounts on the resulting invoices are posted here.

Accounts Payable Code (Liability Account)

The account code for your Accounts Payable G/L account. The amount of any vendor invoices that you enter into the system will post here.

Discounts Taken A/P (Expense Account)

If your vendors offer discount terms on their payables, the system will post those discounts to this account.

P/O Received Not Invc'd (Liability Account)

This is a holding account for P/O's which have been received but have not yet been invoiced (as in the case of a partial receipt).

P/O Freight In Code (Expense Account)

This is the account registering the amount that vendors charge for shipping your orders to you.

P/O Tax Expense Code (Expense Account)

If you are charged tax on P/O's, the system will post these amounts to this account.

G/L Current Earnings (Owner's Equity Account)

Current Earnings is the account where the net income/loss amount is to be posted when the Income/Expense accounts are closed when selecting the 'close' option as a part of printing a balance sheet or a cash flow statement (GL-G, Print Financial Statements).

G/L Retained Earnings (Owner's Equity Account)

This is where the Current Earnings amounts for previous years are saved. When you run the End of Year program, the year-to-date amount in the Current Earnings account will be added to this account.

G/L Clearing Account (Owner's Equity Account)

This account is used if a G/L Account code is not found during a posting. You must enter a G/L Clearing Account code. If you do not set up this account, any G/L account not found during a posting will result in a transaction that will put your accounts out of balance. By using this clearing account, you can ensure that no transactions will be lost.

Where are the programs

Most users will not need to enter anything in this field. If this field is left blank, the current subdirectory is used as the system default. If you have copied the programs BK*.RUN to a location other than the current disk drive and subdirectory, then you should enter the path here.

General Program Operation

G/L account codes set up here must match those you have established for your own chart of accounts using SY-E, Create/Chg G/L Account.

Remember that you are setting up company-wide defaults in this program. Be sure you have read Getting Started before you proceed to use these defaults throughout the rest of Advanced Accounting 7. You can easily add new options later, but changing existing account information can have far-reaching (and undesirable) effects.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?sy_a_a_enterchangecompany.htm