Purpose of Program

Advanced Accounting 7 allows you to make transactions that affect prior years. However, those transactions will not be reflected in the current year until you 'reclose' that prior year. Use this program to do that. (Please refer to SY-I for general information on closing a year.)

Because of this program you can confidently close the books at the end of the last day of your business year (fiscal or calendar) knowing that you will be able to make any and all final transactions necessary to finish the year off. This program can be run any number of times without undo effect.

General Program Operation

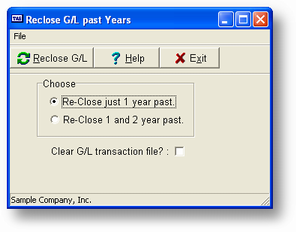

When you choose this program the screen above will be displayed. If you enter 1 only the year past will be reclosed. If you enter 2 both the year past and 2 years past will be reclosed. Even though you can keep 6 years past data in the G/L the reclose process only affects the first two years. Generally, you will only make transactions to the immediate prior year anyway. Please note that the current Retained Earnings balance will be updated. If you answer Y to continue with the reclose, you will be asked if you want to update the beginning balances in your transaction file. The default value is N, which saves all the detail, allowing you to re-close multiple times. If you answer Y, the detail from that year will be lost and the beginning balances updated. When the process is complete the program will return to the Main Menu.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?sy_l_recloseprioryears.htm