Purpose of Program

Use this program to enter the Payroll/General Ledger Interface accounts prior to your first payroll session. By setting up the vendor information properly, you will find that Advanced Accounting 7 can automatically produce summary information that you previously had to produce manually.

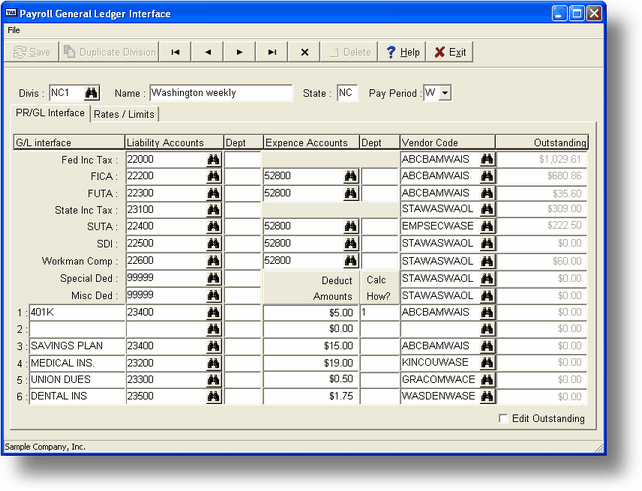

Field Explanations

Divis

This is the Division Code that will identify the accounts and deduction information associated with the payroll division. When each employee is defined to the system using PR-A, Enter/Chg Employees, a division code that has been created here must be assigned to the employee. At least one division designation must be assigned for your system.

You can use divisions to help handle benefits for employees in different states by using G/L departments as the employees' division code.

If you don't require multiple versions of payroll defaults (i.e., you operate in a single state and the same deduction and account categories apply to all employees), then you should create one division and assign all employees to it.

Name

The division name. This field is for reference only; a name such as "Regional" or "Washington" might define a payroll division.

State (Required)

The two letter designator for the state information to be used for this division.

Pay Period

The normal pay period for the payroll for this division. The table below summarizes the system designations by day and by hour for each type.

Days Hours

D - Daily 1 8

W - Weekly 5 40

B - Bi-weekly 10 80

S - Semi-monthly 11 88

M - Monthly 22 176

G/L Interface Liability Accounts

All the fields below require assignment of a liability account in order to accumulate the amounts until they are paid to the designated institution (federal/state government, a bank, etc). These accounts reflect the portion of the payment deducted from the employee salary. If you have set up departments in your chart of accounts, you can override this particular account assignment with a department assignment in the employee's individual record using PR-A, Enter/Chg Employees.

Federal Inc Tax State Disability Insurance (SDI)

FICA Workman Compensation

Federal Unemployment (FUTA) Special Deduction

State Income Tax Misc Deductions

State Unemployment (SUTA)

Expense Accounts

Those categories that have some portion of the deduction paid by the employer should have an account number entered here. FICA, FUTA, SUTA, SDI, and Workman's Comp all require expense account assignments.

Vendor

You will use the vendor field to indicate what institution is to receive the funds from the accounts. For example, FICA might be the bank you use as a depository for Federal Income Tax funds (initially set up under AP-A, Enter/Change Vendors), and SUTA might be a specific state agency that handles unemployment tax. This allows an automatic transfer of payroll totals to standard payees during the payroll check process. When the cursor is positioned in the vendor field, press F2 to select from the vendors you have already set up in AP-A, Enter/Chg Vendors.

Outstanding

The numbers in this column reflect the total amount still outstanding after you have run your payroll checks. This is a figure calculated against the liability accounts only.

Special Deduction

This is a deduction that you assign as a special case as you run payroll. There is no default amount or rate for this kind of deduction. If you are using the Special Deduction type to reimburse out-of-pocket expenses then enter the appropriate expense account instead of entering a liability account. The amounts will post correctly.

Misc Ded

This is a deduction that is associated with each employee record (see PR-A, Enter/Chg Employees). If you have only one deduction that does not require additional specification, you can assign the account here. Otherwise, you should use the 6 other deduction fields at the bottom of the screen to provide further detail for these deductions.

1-6 (Other Deductions)

Advanced Accounting 7 provides for 6 types of "other" deductions. Types 1, 2, and 3 (indicated in the Calc How field) allow for Pre-Tax deductions (flat amount, rate X total hours, and % of gross pay). If you define a deduction as pre-tax, a pop-up box will let you specify which, if any, types of taxes the deduction is NOT exempt from. Types 4, 5, and 6 handle Post-Tax deductions. You can set default amounts here and then override the default if necessary in the employee record (PR-A, Enter/Chg Employees). Note in the sample screen above how these fields have been used. You might use one of these deductions for a 401k account as shown.

The names you assign to these deductions are printed on any screens or reports which reference these deductions. The percentages and amounts you assign to these deductions are used for all employees unless you choose to override them by setting an alternate amount within the individual employee record using PR-A, Enter/Change Employees.

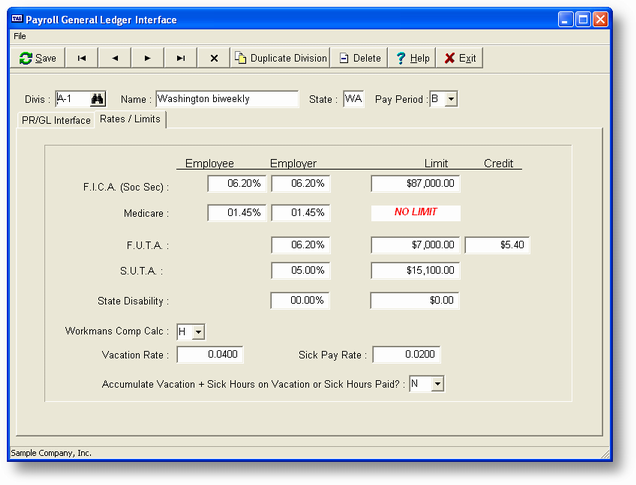

After you have assigned the account codes to the required categories, an additional popup window for entering rates will be displayed. You can also click the tab Rates/Limits to view this screen. The fields in the screen are described below.

FICA (Social Security)

Employee rate, employer rate, and limit. The limit is in terms of maximum gross pay amount, not the FICA deducted amount.

Medicare

Employee rate and employer rate. There is no limit to Medicare.

FUTA

Employer rate, limit, and maximum credit allowed by federal statute. The limit is in terms of maximum gross pay amount, not the total FUTA expense.

SUTA

Employer rate and limit. The limit is in terms of maximum gross pay amount, not total SUTA expense.

State Disability

The employer rate and the limit for State Disability Insurance. The limit is in terms of the maximum gross pay amount, not the total SDI expense. Enter 6.2% as 6.2 not .062.

Workmans Comp Calc

Enter H if Workman's Compensation is calculated as the rate times the number of Hours worked. Enter D if it is calculated times the number of Days worked.

Vacation Rate

This figure, multiplied by the hours worked, determines the number of vacation hours accumulated during the pay period. This is the default value and will be overridden by any value in the individual employee record.

Calculate this figure as follows:

no. of days per year received X the number of work hours per day

覧覧覧覧覧覧覧覧覧覧覧覧覧-

2080 (the number of work hours per year)

If 2 weeks a year are accumulated, the figure would be 10 X 8 / 2080, or .03846154. This figure reflects the vacation time accumulated per hour worked.

Sick Pay Rate

This figure, multiplied by the hours worked, determines the number of sick hours accumulated during the pay period. See the example in vacation rate above to calculate this figure. This is the default value and will be overridden by any value in the individual employee record.

Accumulate Vac & Sick Hrs on Vac & Sick Hrs?

This option determines which hours you use as a base when calculating the amount of vacation and sick leave to accumulate for a particular payroll. The default is to total Regular and Holiday pay and use that as the base amount. The options you can choose here are: Y - Add Vacation and Sick hours used during this payroll to the base amount; O - Add Overtime hours; A - Add all hours; R - Use Regular hours only; N - Use only default hours, Regular and Holiday.

General Program Operation

When you are first setting up your payroll information here, you should enter G/L account codes and vendors for each item. See Getting Started before you try to run a payroll operation using these defaults.

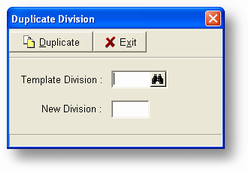

If you are creating multiple divisions that differ in one or two fields only, use F3, Duplicate Divisions, to copy and modify the information you have entered for the first division. The screen below will be displayed.

Enter the template division and the new payroll division code. Click the duplicate button and you will now have a new divistion you can edit.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?sy_d_enterchangeprglinte.htm