Purpose of Program

Use this program to add new employee records or change current ones. You can also use the program to indicate which employees are terminated so that they are excluded from PR-B, Enter Pay Info. (Terminated employees are included in all reports until deleted using PR-G, Print W-2s.)

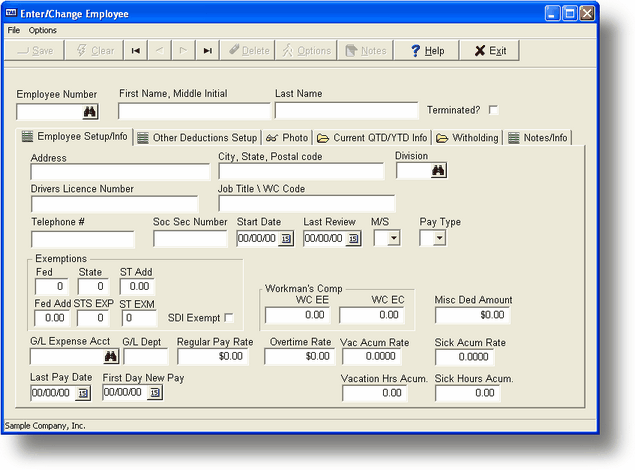

Below is the screen you will use to enter each employee's payroll information.

Field Explanations

Standard Employee Information (Employee/Setup/Info)

This information must be entered and can be changed at any time for all employees.

Num

The employee number. You must assign this number; it is not assigned automatically. This is a 10 digit numeric field. (If you are implementing commissions for your salespeople, you will use this number as the salesperson number as well.)

First Name & M.I.

The employee's first name and middle initial.

Last Name

The employee's last name.

P/R Division

The employee payroll division (4-character alphanumeric field). If you have groups of employees that require different default information, you can set up multiple defaults by creating payroll divisions. For example, you may have employees in different states and these states have different deduction requirements for state taxes or disability. You could set up one division for each state and assign the proper values for all employees in that state.

Another use of division is to reflect the employees associated with G/L departments that are used as profit/cost centers. In this case, you can create divisions that match your G/L Department numbers.

You can set up divisions to reflect the different pay periods that you use to run payroll; for example, hourly vs. weekly pay periods. Employee payroll divisions can be selected in PR-B, Enter Pay Info, in order to see only those employees that have the applicable division type.

Before using PR-A, Enter/Chg Employees you must set up at least one division using SY-D, Enter/Chg PR/GL Interface. Even if you are not going to group your employees using multiple divisions, you must assign a division to every employee.

Address

The employee's street address.

City, State, Zip

The employee's city, state and zip code.

M/S Marital Status (Required)

M: Married / S: Single / H: Single head of household.

Pay Type (Required)

Enter H: Hourly / S: Salaried.

Phone number

The employee's phone number.

Soc Sec Num

The employee's social security number.

Start Dt

The date the employee started work.

T

Terminated: If the employee is terminated or quits, enter Y in this field. The employee will no longer appear when generating payroll information in PR-B. This is a required field; the default entry is N.

Fed

Number of Federal Income Tax exemptions claimed on the employee's W-4 form. If the employee is exempt from Federal Income Tax, enter 99 in this field.

Added

The additional amount (expressed as a positive number), to be withheld from the employee for federal taxes (from form W-4).

St

Number of State Income Tax exemptions. If the employee is exempt from State Income Tax or if you have no State Income Tax, enter 99 in this field.

Added

The additional amount (expressed as a positive number), to be withheld from the employee pay for state taxes.

SSEx

The number of Special State tax Exemptions the employee is entitled to, if your state has them.

St Exm

Special state amounts. This amount is required by certain states for the state tax calculation routine. In many cases, Michigan for one, it is the dollar value of each state exemption claimed.

WC EE

Workman's Compensation cost per hour (in Oregon, per day) deducted from the employee's pay.

WC ER

Workman's Compensation cost per hour (in Oregon, per day) charged to the employer.

G/L Exp Acct (Required)

The General Ledger expense account for the payroll expense for this employee.

G/L Exp Dept

The employee's entire payroll will post to this department. If you do not enter a department code, the default department entered in SY-D, Enter/Chg PR/GL Interface is used.

Reg Pay rate

The regular pay amount per hour (if hourly) or per pay period (if salaried) for this employee.

Ovt Pay rate

The overtime pay rate should use the same criterion as the regular pay rate (hourly or by pay period) for reflecting an overtime pay rate amount.

Misc Ded Amt

A taxable amount which can be deducted from the employee's paycheck each pay period. This deduction can be used in addition to or instead of the standard deductions created in SY-D, Enter/Chg PR/GL Interface. You can use this for such items as garnished wages.

SDI

The State Disability Insurance exemption. If the employee is exempt from state disability deductions, then enter Y; if not, enter N. If SDI is not used in your state, enter a Y.

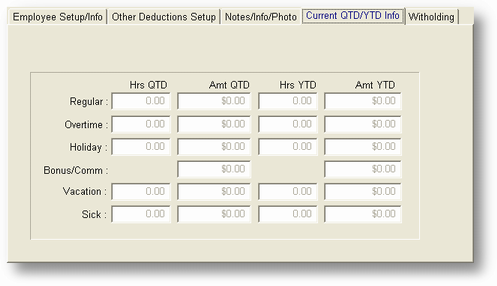

New Employee Payroll Information (Current QTD/YDT Info)

This information can only be entered when adding a new employee record. Afterwards, the amounts displayed will summarize the activity of previous pay periods.

Regular

Regular pay received (hours and amounts), for quarter to date and year to date.

Overtime

Overtime pay received (hours and amounts), for quarter to date and year to date.

Holiday

Holiday pay received (hours and amounts), for quarter to date and year to date.

Last Pay

The date of the last payroll for this employee.

Bonus/Commissions

Bonus pay/commissions received for quarter to date and year to date.

Vacation

Vacation pay received (hours and amounts), for quarter to date and year to date.

Sick

Sick pay received (hours and amounts), for quarter to date and year to date.

Hrs Due

The number of vacation and sick hours accumulated and not yet used for this employee.

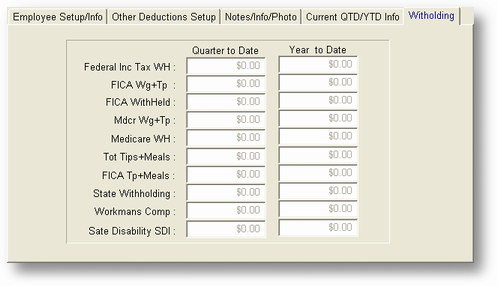

Withholding (Page 5)

Federal Income Tax

The amount of Federal Income Tax withheld quarter to date and year to date.

FICA/Medicare Withheld

The first column to the left of the slash is the amount of FICA withheld quarter to date. To the right of the slash is the amount of Medicare withheld quarter to date. The right column are year to date amounts.

FICA Pay/FICA Tips

The first column to the left of the slash is the amount of FICA Pay quarter to date (this will equal Gross pay until the employee reaches the limit). To the right of the slash is the amount of Tips recorded for this employee that help make up a part of total FICA Pay quarter to date. The right column are year to date amounts.

State Withholding

The amount of state income tax withheld quarter to date and year to date.

State Disability Ins.

The amount of State Disability Insurance premiums withheld quarter to date and year to date.

Wrkmns Comp Insur

The amount of workman's compensation insurance cost withheld from the employee quarter to date and year to date.

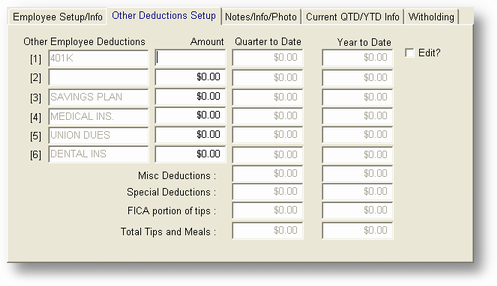

New Employee Payroll Information (Page 2)

You can view this screen clicking the Other deductions tab.

Sick Hours Accumulation Rate

This rate is multiplied by the number of Regular and Overtime hours and added to the number of Sick Hours available each time a payroll is posted. This field will default to the rate in the PR/GL Interface file (SY-D, Enter/Chg PR/GL Interface) for this division. If you don't want to accumulate sick hours for this employee then enter 0 here.

Vacation Hours Accumulation Rate

This rate is multiplied by the number of Regular and Overtime hours and added to the number of Vacation Hours available each time a payroll is posted. This field will default to the rate in the PR/GL Interface file (SY-D, Enter/Chg PR/GL Interface) for this division. If you don't want to accumulate vacation hours for this employee then enter 0 here.

Other Employee Deductions (1-6)

User-defined deductions with a deduction amount/percentage and amounts withheld quarter to date and year to date displayed. The descriptors and default amounts/percentages for these fields are entered in SY-D, Enter/Chg PR/GL Interface. You can enter a description and amount/percentage here for a deduction which differs from the default, or use the default percentage from SY-D. Please note that you cannot change how the deduction is calculated; that information is specified in SY-D. For posting purposes, the G/L Account will be the one specified in SY-D. The deduction descriptions and amounts will default to the corresponding description and amount in the PR/GL Interface file (SY-D, Enter/Chg PR/GL Interface) for this division. If you don't want a deduction to be active for this employee then enter 0 for the amount.

Misc Deductions

The amount of miscellaneous deductions withheld quarter to date and year to date.

Special Deductions

The quarter to date and year to date withholding amounts of the Special Deductions entered in PR-B.

Tips Recorded

The amount of tips recorded for this employee quarter to date and year to date.

Meals Recorded

The amount of free meals recorded for this employee quarter to date and year to date.

General Program Operation

Adding a New Employee Record

When you add a new employee, the cursor is located in the Num field. Enter the new employee number and press ENTER. If that number has already been assigned, the corresponding record is displayed. In that case, press F3 to clear the screen fields, and enter another number.

You will need to have the employee's W-4 form at hand to complete this entry, or use the worksheet in Appendix E.

After you enter the new employee number, fill out the rest of the fields. The Num, M/S (marital status), P/T (pay type), and G/L Exp Acct fields are required fields; you must make entries to these fields before you are allowed to save the record.

When you are adding a new record, you can enter all of the quarter and year to date amounts on both the first and second pages. You will need to use this feature when adding your existing employees during your initial set-up (see Getting Started).

You can go from the first to the second page and back by using the PAGE UP and PAGE DOWN keys, and you are transferred to the second during entry when you press ENTER in the last field on the first page.

The user-definable deductions on the second page (1-6) can be set here to values which will apply to this employee only. The default withholding from the PR/GL interface (SY-D) is applicable to all employees unless changed here. You can also use SY-D to indicate whether the deductions are taxable or non-taxable.

Changing an Existing Employee Record

To find an existing employee record, enter the employee number at the Num field and press ENTER, press F2 to use the list display option (F2), or use the standard record search keys. You may change any entry except for the employee number and QTD/YTD amounts.

Deleting an Existing Employee Record

You may not delete an employee record in this program. If you enter Y at the T (terminated) entry field, the employee will no longer be displayed in the PR-B, Enter Pay Info program. Then, after the W-2's are printed in PR-G, Print W-2s all terminated employees can be deleted from the file.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?pr_a_enterchangeemployees.htm