Purpose of Program

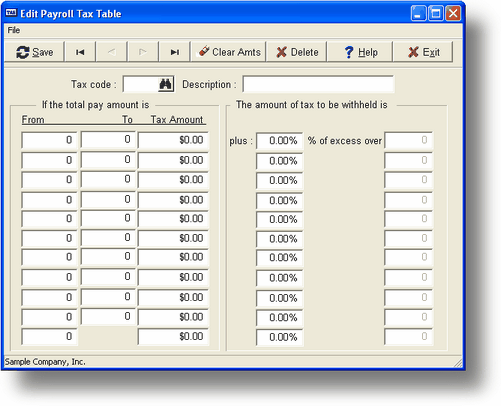

Use this program to enter or maintain a set of tax tables for the states that have an income tax and for Federal taxes. A set of state tax tables is provided with Advanced Accounting 7 that includes various state tables, with separate records for single, married, and single head of household status. Because of the possibility of changes in local tax structures, please verify the tables that apply to your state before using the payroll module. Below is a sample screen of this program.

Field Explanations

Tax code

A 3 character alphanumeric field which, in Advanced Accounting 7, usually designates the state and marital status for the table. For example, WVS represents West Virginia Single tax rates. Federal tax tables are stored under US0, USM and USS.

![]() The US0 record is actually not a tax table. Rather, the amount in the Tax Amount column represents the dollar value of each Federal Exemption claimed by your employees. This should be the only amount in the US0 table. All other columns should be set to 0. Due to indexing for inflation, this number generally needs to be changed each year, as do the USS and USM tax brackets. Consult IRS Circular E for the new amounts each year. Be sure to change your tax tables only after the last payroll of the old year has been run.

The US0 record is actually not a tax table. Rather, the amount in the Tax Amount column represents the dollar value of each Federal Exemption claimed by your employees. This should be the only amount in the US0 table. All other columns should be set to 0. Due to indexing for inflation, this number generally needs to be changed each year, as do the USS and USM tax brackets. Consult IRS Circular E for the new amounts each year. Be sure to change your tax tables only after the last payroll of the old year has been run.

Description

The text description of the contents of the tax table.

Pay Amount Fields

From

The lower limit of a tax bracket.

To

The upper limit of a tax bracket.

Tax Withholding Fields

Tax Amount

The minimum tax for a tax bracket.

Plus column

The extra percentage of income to be added to the minimum tax in order to increase the tax evenly within a tax bracket.

Excess over column

The lower limit for calculation of the percentage tax. This is the same amount displayed in the From field.

General Program Operation

Before using these tables, verify that the one(s) you need to use reflect the current tax structure of your state. Much of the actual tax calculation goes on inside Advanced Accounting 7. For some states, the entire calculation takes place internally and no tax table is necessary. If there are inaccuracies, you may need a software update. Contact your dealer or Computer Accounting Solutions. if this is the case.

This program only needs to be used when and if tax changes occur. If these changes affect the amounts and percentages only, you can adjust these amounts within this program. Check the screen display against your most recent state tax tables to see if the tax amounts are correct. These tables are associated with fields in PR-A, Enter/Change Employees and PR-B, Enter Pay Info based on the State field entry in SY-D, Enter/Chg PR/GL Interface (the two letter state code that you define for each payroll division is used when calculating taxes to find the first 2 characters of the Tax Code here).

Note : When entering tax table information in Advanced Accounting 7. All tax tables used are the calculated / Exact method using the annual tax tables provided by your state and the federal government.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?pr_k_maintaintaxtables.htm