Purpose of Program

Use this program to enter payroll information prior to printing payroll checks. This is the first step in the normal payroll procedure. The second is to print the Payroll Register (PR-C) and the third is to print the payroll checks (PR-D).

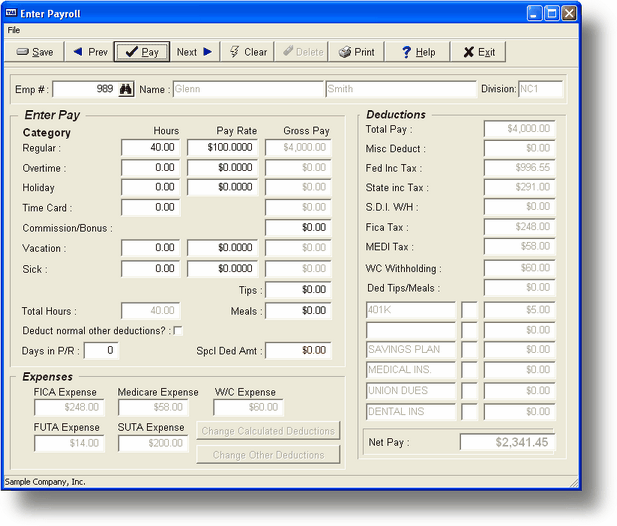

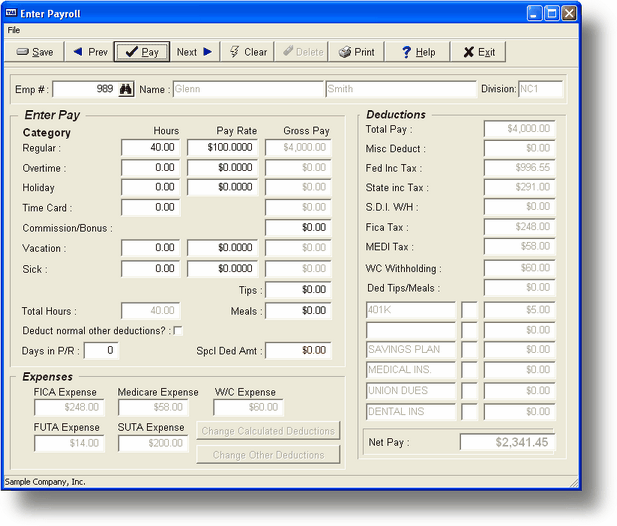

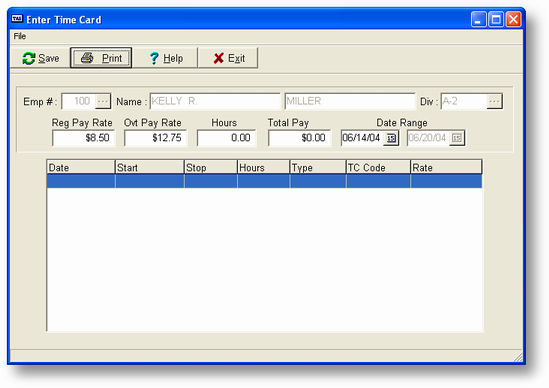

Below is the screen used to enter pay information for each employee for the current pay period.

Field Explanations

Emp

The employee number and full name from the employee file.

Div

The employee's division as set up in PR-A, Enter/Chg Employees. If you have divisions that use different pay periods, this field can help you determine which employees should be updated for the current payroll. When you first select this program, you are allowed to select which division you want to run payroll for; the option to run payroll for all divisions is included.

Pay ?

Indicate whether or not you want to enter payroll information for this employee (Y or N).

Pay Categories

Regular

The regular pay hours, rate and Gross Pay amount (rate X hours). In the case of a salaried employee this will show the number of hours in the pay period and total pay for the period.

Overtime

The overtime pay hours, rate and Gross Pay amount (rate X hours).

Holiday

The holiday pay hours, rate (default set by Regular rate), and Gross Pay amount (rate X hours).

Time Card

The total of all time card hours and the corresponding total pay entered for this employee.

Bonus/Comm

The bonus pay amount. This also reflects any commissions transferred through PR-J, Transfer Commissions. You cannot change this commission amount once transferred.

Vacation

The vacation pay included on this paycheck in hours, rate and gross pay amount (rate X hours).

Sick

The sick pay included on this paycheck in hours, rate and gross pay amount (rate X hours).

Tips

The amount of tips to be recorded for this employee during this pay period. This amount is added here so that taxes can be calculated. It is automatically deducted from the net pay amount.

Meals

The value of any free meals the employee received during this pay period. This amount is added here so that taxes can be calculated. It is automatically deducted from the net pay amount.

Days in P/R

The number of days worked during the payroll period. This field will default to the number of days in the pay period chosen in SY-D, Enter/Chg PR/GL Interface for that division.

Spcl Ded Amt

You may use this field to enter special deductions for this employee; for example, to reimburse the employee for out of pocket expenses. If the field is used for reimbursement, enter the amount as a negative number. No taxes will be calculated on this amount; the amount will be deducted from net pay.

Total Pay

Reg Pay Amount + Overtime + Holiday + Bonus+Time Card + Vacation Pay Amount + Sick Pay Amount.

Misc Deduct

The amount in the employee's miscellaneous deduction field in the employee record (from PR-A).

Fed Inc Tax

The amount of Federal Income Tax withheld on this paycheck.

State Inc Tax

The amount of State Income Tax withheld on this paycheck.

SDI W/H

The amount to be withheld for State Disability Insurance from the employee.

FICA Tax

The amount of FICA withheld on this paycheck.

MEDI Tax

The amount of Medicare withheld on this paycheck.

W/C Withholding

The amount of Workman's Compensation Insurance withheld from the employee. (Rate X Hours or Days)

Miscellaneous Deductions

The amount of each of the miscellaneous deductions withheld on this paycheck.

Ded Tips/Meals

The amount recorded above for tips and meals is deducted here.

Net Pay

The calculated net pay for this paycheck.

FICA Expense

The amount of FICA to be paid by the employer.

FUTA Expense

The amount of Federal Unemployment Insurance expense to be paid by the employer.

MEDI Expense

The amount of Medicare to be paid by the employer.

SUTA Expense

The amount of State Unemployment Insurance expense to be paid by the employer.

W/C Expense

The amount of Workman's Compensation Insurance expense to be paid by the employer. (Rate X Hours or Days)

General Program Operation

Adding New Payroll Records

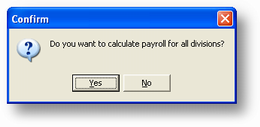

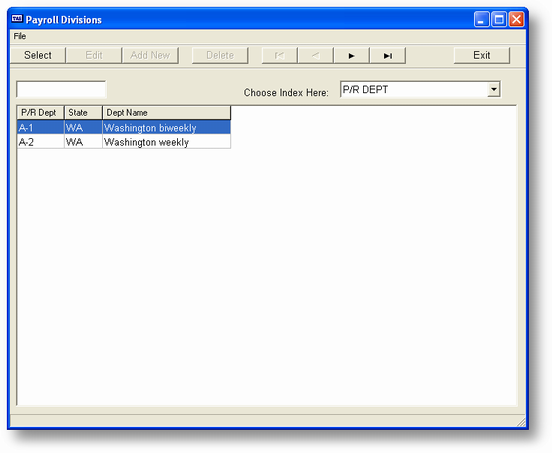

When the program is run you are asked if you want to calculate payrolls for all divisions (dialog box above). If you answer N then you must choose one of the divisions listed (see below).

Once you've chosen a division (or answered Yes to the original question) the first non-terminated employee in the file applicable to your division selection is found and displayed on the screen.

The employee's number is in the Emp# field and the employee's first and last name is displayed on the same line.

The cursor is in the Pay? button. If you want to enter payroll information for this employee, then click the Pay button. If this employee will not be included on the payroll, then click the next button. you can also use the Previous button.

You may also click employee number field. You may then enter a specific employee number or use the F2 search capability to call up the payroll employee information entry screen.

If you click Pay? button, the cursor moves to the Hours field of the Regular pay category. Hours defaults to the number of hours in the payroll period specified in SY-D, Enter/Chg PR/GL Interface. Pay Rate defaults to the entry in the employee record. You may change both the hours and the payroll rate. The Gross Pay amount is calculated automatically. As you add entries, the total hours are displayed automatically as a running total.

If you do not want to enter hours for any of the six categories, just press ENTER or type 0 in the Hours column. If you do not record any hours in any column, then information is not recorded for the employee.

When the cursor gets to the Time Card field you will be asked if you want to enter Time Card Hours for this employee.

If you answer Y the following screen will be displayed.

Time Card Entry

If you have not made any time card entries previously for this employee you will be able to adjust the beginning date in the date range. You will be able to enter time card entries for those dates ONLY within the range listed. The end date is automatically calculated based on the information entered in SY-D.

Next, the cursor will be placed on a blank line. If you have already made time card entries then the cursor will be on the first entry. Press the ENTER key on a blank line to make a new time card entry (or press the INSERT key). Move the cursor to the appropriate line and press the ENTER key to modify an existing time card entry.

The first field is the date the work was done. This must be within the date range listed at the top of the screen.

Next, you can enter the Starting and Stopping times. If you do this the program will automatically calculate the number of hours worked. If you enter 0 for Start Time then the cursor will move to the Hours field and you will have to enter the number of hours worked. You must enter either the Start/Stop time range or the actual number of hours worked for this entry.

Entry the type next; R - Regular, O - Overtime, H - Holiday, V - Vacation, S - Sick, B - Bonus.

Then enter the Time Card Rate code. Each employee has their own rates entered in PR-Q, Enter Time Card Rates. To list the available rates press the F2 key.

The Rate amount will then be displayed and you will be able to change it if necessary.

When you press the ENTER key after the Rate the program will calculate the actual pay and add it and the hours to the Hours and Tot Pay fields at the top of the screen. You can continue to add new entries or change existing ones as necessary. When you press the ESC key the program will return to the main pay entry screen. The hours/amounts entered during this process will be automatically reflected on the screen.

If you need to delete an existing time card entry move the cursor to the appropriate line and press the DELETE key. The program will ask you to confirm the deletion.

After you make the appropriate time card entries, or if you answered N to the Enter Time Cards question, you will be able to enter any Bonus pay amount. This would be for commissions paid or special pay, etc. You will also be able to enter any Vacation and Sick hours used, Tips recorded and the value of any free Meals given to this employee.

If all of your entries are 0 the program will return to the Regular Hours field. You will not be able to continue until you enter some sort of pay for the employee. If you wish to skip the employee and go to the next then press the UP ARROW key from the Regular Hours field and you will be placed in the Employee Number field. Enter a different employee number or press the F2 key to choose the next employee.

If you have recorded any pay amounts the program then allows you to change the Number of Days in Payroll. The value defaults to the number of days in the pay period from SY-D. You might, however, want to change the number of days if you are also including vacation pay or extra pay days on the check. The program calculates taxes based on the number of days. Therefore, if the pay amount is for more than the normal number of days in the pay period, you should change the number of days to the correct number. If you do not, then the incorrect tax amount will be withheld from the employee's pay.

The last entry is the Special Deduction Amount. You may use this field to record special deductions that occur only rarely or to reimburse the employee for out of pocket expenses.

If you are using the Special Deduction Amount field to reimburse the employee, enter the amount as a negative number, i.e., -100.00. This way the employee will get the full amount and it will not be added to the employee's gross pay, nor included in tax calculations.

After you make the Special Deduction Amount entry, the program calculates the other deduction amounts. The program then asks if you want to change the deductions:

If you do, answer Y, and the cursor is placed in the Misc Deduct field, and you can then edit the deductions. If there are some deductions that should not be included in the current payroll, change the amounts to zero here. (You can use Ctrl +U to clear the field.)

If you answer N when asked if you want to change the deductions, you will be asked if all of the entries are correct:

If you answer Y, the information will be saved and the program will continue to the next employee.

If you answer N, the cursor is placed in the Hours column again and you will be able to change any of the entries. If you don't want to save the information for this employee, then set all the hour amounts to 0 and the program automatically continues to the next employee.

Changing an Existing Payroll Record

The initial process is the same as in entering a new payroll. You still choose all divisions or a specific division and the first employee is displayed. If you have already entered hours/amounts for this employee then that will be displayed. If you want to modify the amounts then press ENTER at the Pay button and you will be able to change any value. If you want to scan through the employees one at a time you can use Next pr previous button at the program will move to the next or previous employee. When you find the employee click the pay button to edit that payroll record.

![]() Just because you use the Next or Previous button here the amounts entered previously will NOT be deleted. See Deleting an Existing Payroll Record below.

Just because you use the Next or Previous button here the amounts entered previously will NOT be deleted. See Deleting an Existing Payroll Record below.

To retrieve a specific employee's pay record, click on the Emp# when the cursor is in the Pay? field. This will move the cursor to the employee number field and you can enter the number of, or perform a search for, the employee whose pay record you wish to change.

If this is the only employee to be changed, save the record by pressing F10 or the Save Button and then press ESC when the cursor is on the Pay button? to exit from the program. If you want to change other employee files, you can leave the current employee record by entering clicking the next button or Previous button.

If the employee has time card hours the menu option below will be displayed:

**SCREEN**

If you choose Convert the time card hours will be converted to the equivalent regular hours for the employee.

Deleting an Existing Payroll Record

You can delete an employee pay record until you print payroll checks, when the payroll records for that pay period are cleared.

To delete an employee's pay record call up that employee as you would do in changing an existing record above. When the cursor is in the Regular Hours field press the F4 key or click the delete button. You will be asked if you wish to delete the pay record. If you answer Yes the pay record (and all time card records) for this current payroll for this employee will be deleted. You will be returned to the Pay button and you can either enter new payroll info for this employee or click the next button and go to the next. You can also click on the Employee Number field to enter a specific employee or press ESC to exit the program.

Printing the Current payroll records.

You can print the Current payroll records you have entered by clicking the Print button. This process can be done as many times as the user needs to check there work. for more information about this report you can look at the PR-C - Print Payroll Register.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?pr_b_enterpayinfo.htm