Purpose of Program

This program allows you to view accounts from the General Ledger Chart of Accounts and gives you a convenient way to change budget amounts to project future performance. You are not allowed to create new accounts or to change existing ones in this option.

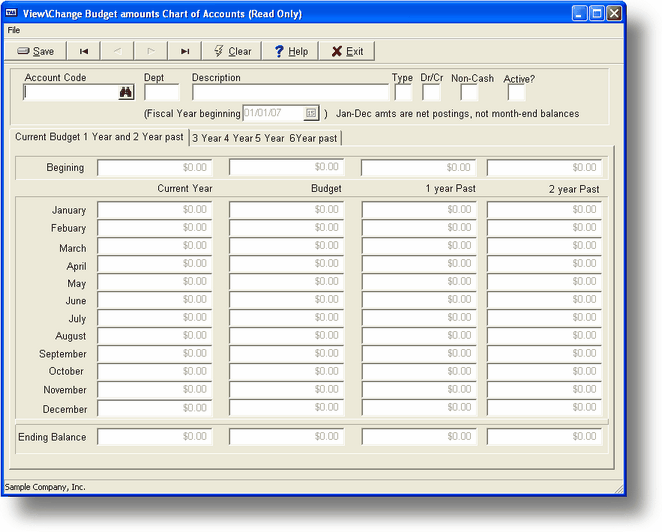

To create accounts or change current amounts in G/L Accounts, see SY-E, Create/Chg G/L Accounts. Before changing or deleting a G/L Account, check your default accounts in the System Maintenance module to be sure you are not affecting system defaults. The sample screen below is followed by explanations of the screen fields.

Field Explanations

Acct Code

The actual G/L account code or number. This field specifies which General Ledger account you wish to view.

Dept

The G/L department code. This field specifies the department whose General Ledger account is to be viewed. If you are not using G/L Departments, or if the account you wish to view has no department name, leave this field blank.

Account Display

The following fields are filled in automatically after the you enter the Account Code and press ENTER. These descriptions are given solely to explain the display, as the only items you are allowed to change are the Budget amounts.

Description

The title for this G/L account.

Type

The type of account. Enter A - Asset, L - Liability, O - Owner's Equity, I - Income, E - Expense.

Norm Dr/Cr

The account normally has a Debit (D) or Credit (C) balance. Asset and Expense accounts are debit accounts, while Owner's Equity, Income, and Liability accounts are credit accounts. The program displays the account status automatically.

Non-Cash

The entry in this field indicates if this account is or is not a non-cash expense account. This entry is used for the Changes in Financial Position (Cash Flow) statement generated using GL-G, Print Financial Statements. When determining your actual ending cash position, non-cash expense amounts are added back to net income. Non-cash expense amounts are those that do not have cash or a check paid for them. For example, depreciation expense would be one of these.

Active

If this is set to N (not active) the account will not be displayed in G/L lookups. The default value is Y.

FY Beg

The beginning of the current fiscal year. For information only.

In each column, the Beginning Balance represents the starting balance of the account for the year. The monthly amounts represent the total net effect of transactions during each month; they are NOT month end balances. The Ending Balance represents the current balance in each account. It is calculated by adding each monthly amount to the Beginning Balance.

Current

These are the monthly amounts that have been posted from the various programs in the current year.

Budget

These are the monthly amounts that you have entered as comparisons for the actual (Current) amounts that will be posted. Budget amounts may be changed in this program and used to compare financial statements. This is to assist you in your projections or to review performance.

1 Year Past

The monthly posted amounts from the previous year.

2 Years Past

The monthly posted amounts from 2 years past.

![]() If you have recently entered a prior-year transaction elsewhere in the system, you will see that entry reflected in the monthly amounts in one of the two columns above. However, the ending balance of that prior year will not include the amount until you have run SY-J, Reclose Prior Years.

If you have recently entered a prior-year transaction elsewhere in the system, you will see that entry reflected in the monthly amounts in one of the two columns above. However, the ending balance of that prior year will not include the amount until you have run SY-J, Reclose Prior Years.

3-6 Years Past

The monthly posted amounts from 3 through 6 years past. To review this data press the PAGE DOWN key when you are in the first screen.

General Program Operation

Viewing A G/L Account

When the program screen is displayed, the cursor is located in the Acct Code entry field. Enter the full account code at the Acct Code field location and press ENTER, or use the standard record search keys (see Standard Key Functions). If you cannot remember the Code you want, pressing F2 or clicking at this point will display a list of G/L Accounts.

Once the Acct Code is entered, the account information is displayed. Press F3 to clear the screen fields prior to displaying a different Account Code.

You can change only the budget amounts balances in this program. The program will automatically calculate the Ending Balance for that column. If the account is normally a credit (Cr) Type, an entry of $100.00 will be automatically stored and displayed as $<100.00>. It is not necessary to enter it as a negative number, as -100.00. However, the entry is displayed as -100.00 when you are in that entry field to make a change.

You must save the record before your budget changes are permanently updated in the file.

To view the amounts for 3 thru 6 years past click the Tab for 3 thru 6 once you have an active G/L account on the screen.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?gl_a_viewchgchartofaccou.htm