Purpose of Program

This program allows you to enter, change, or delete state tax authority records. In this way, you can enter specific authorities for sales tax collection on a state by state basis, giving you the flexibility to operate in multiple states and still keep your sales tax liabilities in order. You must set up your tax authorities before entering a Y in the Taxable? field of a customer record to initiate this automatic tax transfer facility. You will be able to keep three distinct sub-districts or sub-authorities for each main taxing authority record. This will allow you to easily keep track of the information required by individual taxing districts where you do business.

Use this program also to print Taxing Authority information and to transfer taxes owing to A/P.

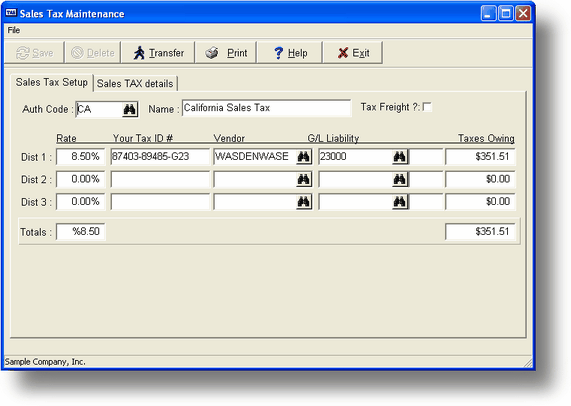

The screen used to create/modify tax authorities is provided below.

Field Explanations

Auth Code

The five character code you want to use for this specific tax authority record.

Name

Write out the tax authority name in this field.

Tax Freight?

If freight charges are to be taxed under this authority, enter Y here.

NOTES

If the word NOTES shows up to the right of the Tax Freight field then you have notes recorded for this taxing authority. To display them press the Alt-F1 key. For more information please see TASNotes.

For each of the three districts you can enter:

I.D. Number

Your district Tax I.D. number (not required). This is a 15 character alphanumeric field.

Tax Rate

The rate at which sales are taxed for this district. For example, 8.1% is filled in as 8.1. The rates entered for each district are totaled to get an effective rate for this taxing authority.

Vendor

Type in the code for the vendor to whom the outstanding amount is to be paid; for example, the appropriate state agency for this tax. This is used in Transfer Taxes Owing section of this program.

G/L Liability

The liability account to which the collected taxes will be posted.

Outstanding

The amount of taxes collected that have not yet been deposited.

Taxable Sales

The total taxable sales, by monthly totals, recorded for this tax authority.

Non-Taxable Sales

The total non-taxable sales, by monthly totals, recorded for this tax authority.

Tax Collected

The total tax collected, by monthly totals, for each district.

General Program Operation

Before running this program, you must have entered appropriate vendors for your sales tax withholding in AP-A, Enter/Change Vendors.. See Getting Started for more information on these issues.

To enter a new tax authority, enter the code you wish to use in the Auth Code field. If a record already exists for that code, the record is displayed. If that happens, clear the screen fields by pressing F3 and enter another code.

Fill in the Name and enter Y or N, as appropriate, in the Tax Freight? field. You will now be able to enter the Sales Tax Rate, ID#, Vendor Code, and G/L Liability Acct number for each district. For a new taxing authority the program allows you to fill in the Outstanding amount and any monthly totals. You are not required to fill in all three districts. If you only have one district for the taxing authority then just fill in Dist 1. If you have two then use Dist 1 and Dist 2. When you have filled in the necessary fields, save the record by pressing F10 and the tax authority is then available when creating customer records (AR-A) and sales orders (SO-A).

If you want to make changes to an existing record or delete a tax authority, call up an existing record by entering a state code or by using the record search keys. You can change the information in any of the upper fields except the outstanding amounts, and you cannot alter the monthly amounts.

To delete the record once displayed, press F4. The program will ask you to verify the request.

Print Tax Authorities

This will generate a report of the amounts owed to your tax authorities. The report contains all of the information shown in the main AR-L screen. Run this program as a preview before the Transfer Taxes Owing process. A sample report is provided in Appendix F.

When you press F3 from the main screen, the screen above is displayed. You can limit this report by entering a range of authority codes and you can print totals only or the year to date presented in detail by month. When the program finishes printing, you are returned to the main screen.

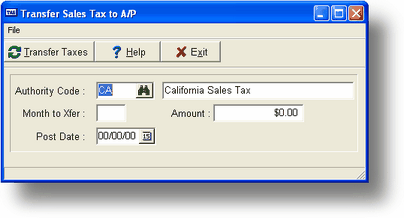

Transfer Taxes Owing

Use this option to transfer the sales taxes held in the G/L Liability accounts to Accounts Payable. The amounts transferred will appear in the A/P vendor records where they can be selected for payment by A/P check. You can also mark the payables as ready to pay so that you won't have to go through the choose to pay process before printing the actual check.

The Amount Outstanding is updated every time sales invoices are posted, and with every tax owing transfer. You may choose which amounts and what portion of the amount to transfer.

This option is typically run at the end of the month or quarter.

Press ^T (CTRL+T) or Click on the Transfer button at the main screen and the screen above is displayed. Next enter the code for the appropriate taxing authority. Press the F2 key for a list.

If you don't enter a taxing authority here (leave the Authority Code blank) the list of amounts owing will be for all authorities. If you choose to create payables the correct vendors will be used per your entries already made for the appropriate taxing authority.

A list, by month, will be displayed of the outstanding taxes owed. Choose the appropriate month (and amount) and then enter the posting date. You will also be able to mark the payables as ready to pay also. This will eliminate the choose to pay process prior to printing checks.

The amounts are automatically transferred to Accounts Payable, against the vendor accounts you defined for this operation when setting up (see Getting Started). When the amounts are transferred the next A/P invoice number is updated, the vendor account outstanding amounts are updated, the transaction is posted to the General Ledger and the Credit Purchases Journal, and the outstanding taxes in the authority record are updated.

Once the amounts are transferred, the program returns you to the main screen.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?ar_l_salestaxmaintenance.htm