Purpose of Program

This program will print the employee's year to date payroll information on pre-printed W-2 forms. It will also display information on W-2s printed previously for the employee.

If the employee has a Y in the Terminated (T) field, you have the option of deleting the employee after all W-2's are printed. The remaining employees' QTD and YTD amounts can be cleared at this time.

You must clear the QTD and YTD amounts only after the last payroll of the calendar year and before the first payroll of the new year, in order to be sure that this information is accurately reflected.

Pre-printed W-2 forms are available from the CAS authorized forms manufacturer. For more information call 800-358-4222 or 928-257-1236. Also, more information about forms is in Appendix E.

![]() You must print W-2s after the last payroll of the old calendar year and before the first payroll of the new year. If this is not possible at the time (perhaps you don't have the forms yet) create a temporary new company after the last payroll (SY-J). Use the data from the real company to create the new one. Then print the W-2s to screen for the real company so that QTD and YTD payroll information is cleared. Then you can proceed with payroll processing for the new year for the real company. When you are ready to print the W-2s on actual forms, do so using the new temporary company. After printing W-2s, you can then delete the new company using SY-J again.

You must print W-2s after the last payroll of the old calendar year and before the first payroll of the new year. If this is not possible at the time (perhaps you don't have the forms yet) create a temporary new company after the last payroll (SY-J). Use the data from the real company to create the new one. Then print the W-2s to screen for the real company so that QTD and YTD payroll information is cleared. Then you can proceed with payroll processing for the new year for the real company. When you are ready to print the W-2s on actual forms, do so using the new temporary company. After printing W-2s, you can then delete the new company using SY-J again.

General Program Operation

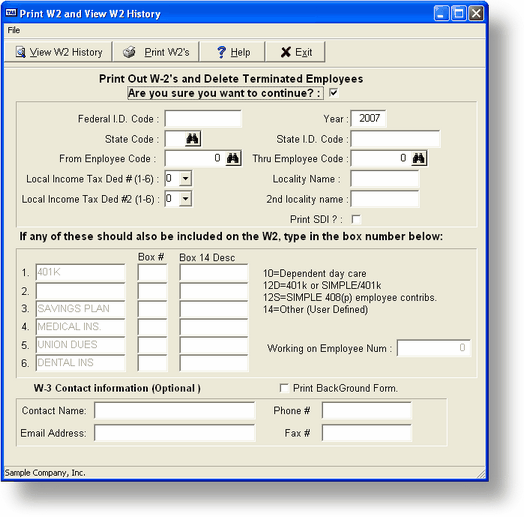

When the program is chosen from the main menu, the screen above will be displayed.

Display W-2 History

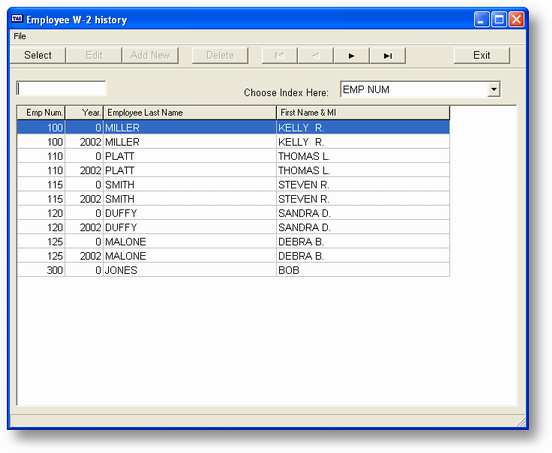

Use this option to display information about previous W-2s printed for an employee. Each year is kept as a separate record.

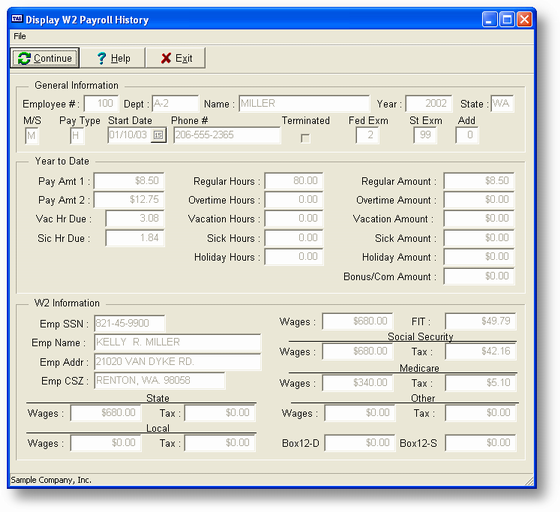

When this option is chosen a list of employees and W-2 years is displayed as above. Choose the employee + year you want to see. When you do the screen below is displayed:

When you press any key the program returns to the original list. Press the ESC key or click on the Exit button to return to the main menu.

Print W-2s Button

This will do the actual W-2 printing.

You can then enter your Federal and State (if applicable) I.D. numbers., local tax names, and you will be able to specify which deductions should print in what box on the form. The W-2's will be printed for each employee with the I.D. codes you specified.

After the printing is complete, the program will ask if you want to delete the terminated employees. If you enter Y, the program will check the file for any terminated employees and remove them automatically.

The program then asks if you wish to clear the QTD and YTD amounts from the employee record. This should only be done when you are ready to begin your new year.

If you answer Y, the quarter and year to date figures are deleted from each employee's file.

If you do not choose to clear the QTD and YTD amounts, you can run this program again. This feature allows you to print a reference copy to check for accuracy, or to keep a disk file of your W-2 information. However, the QTD and YTD amounts must be cleared from the employee record before running the first payroll of the new year, or else the QTD and YTD amounts will include data from both years.

We strongly recommend that you print this information on plain paper first to check for accuracy, and that you back up the payroll data files (BKPR*.B) before printing on W-2 forms and deleting records.

Once the terminated employees are removed from the file, you cannot recover them. If any employees are removed by accident, they must be reentered as new employees.

When the QTD and YTD information is cleared from the employee record, or if you choose not to clear this information, the program returns you to the main menu.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?pr_g_printw_2s.htm