Purpose of Program

Form 1099-Misc is submitted to the Federal government once a year. A copy is sent to the 'vendor' also. Refer to the appropriate booklet for regulations regarding this form. This program works in conjunction with your Accounts Payable and prints a 1099 for each vendor that meets your specifications. Be sure to print this form before running SY-K, Year End Routines, as that program will clear the data required for this form. If you have not been using the Accounts Payable module for an entire year the amounts printed will not be correct. You will need to generate the 1099s using a different method. A suggestion is to add to the system-generated payment totals those payments made prior to the time you began using Accounts Payable.

General Program Operation

You should start by verifying that each 1099 vendor has a Tax ID number. This number is printed on the 1099 form. You can add this ID number in AP-A, Enter/Change Vendors.

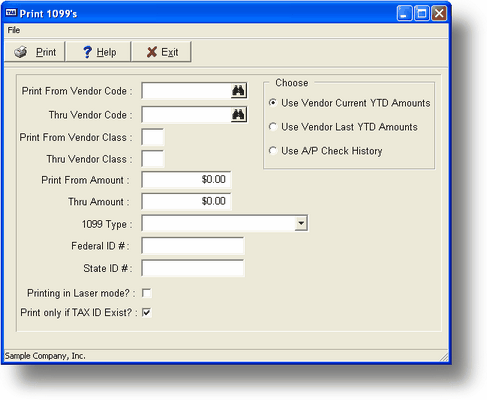

When running this program, you are asked to determine which vendor's 1099s are to be printed. Enter a from and thru vendor code (or use the F2 List Display Option), a from and thru vendor class, and a from and thru amount. Simply press ENTER at these fields if you do not want to specify limits.

Vendor Classification is a good way to determine for which vendors you want 1099s printed. For example, you could enter 99 (for 1099) in the Vendor Class field for each vendor that should receive a 1099.

If your 1099s are to be generated only for vendors with purchases in a certain dollar range, enter that range in the from and thru amount field. For example, if you are only going to generate 1099s for vendors that you have paid $500 or more, enter 500 in the from field and leave the thru field blank.

The next option allows you to choose which type of 1099 you are printing. The most common choice will be option #6, 'Non-employee Compensation.'

Follow this by supplying your Federal Identification number, which will be printed on each 1099.

Lastly, you are given an option to only print 1099s for vendors who have a Tax ID number entered. If you enter N to this question, 1099s will be printed even if a Tax ID number does not exist for a given Vendor and it falls within the other ranges entered above.

Printing the Form

When you are finished entering all options, the program will print the forms, one for each vendor. You are given the choice of printing to the screen, printer or disk file. Have your continuous form 1099s in the printer, ready to go. These forms are available from the CAS authorized forms supplier. They can be reached at 1-800-358-4222 or 928-257-1236. Also, more information about forms is in Appendix E.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?spr_a_form1099_miscnon_e.htm