Purpose of Program

This program provides an alternative to the standard payroll program to print W-2s. For those companies which are required to submit W-2 information on magnetic media, this program creates the appropriate disk file. The information for this program comes from the year's payroll data and will be correct only if you have been running this system for the full year. Also, make sure that if you run the standard W-2 printing program first that you DO NOT clear the employee data. You will be given an opportunity to do so here. If you have not printed paper W-2s first you must run that program before clearing the employee data.

Field Explanations

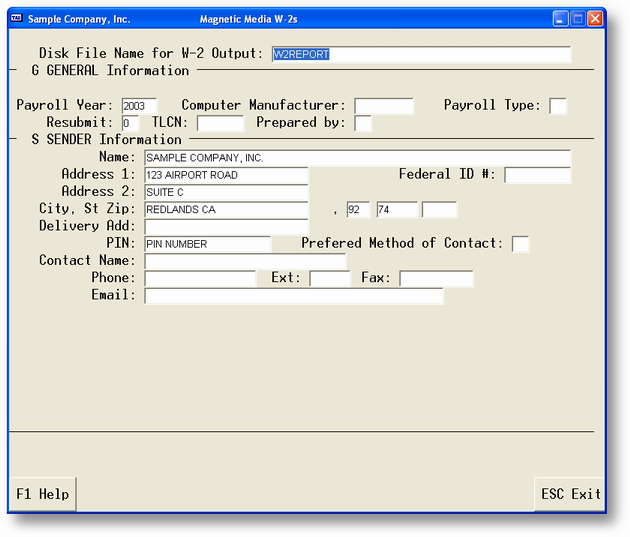

Disk File Name for W-2 Output

This is the file where the W-2s will be saved. The program defaults to W2-year.OUT where year is last year, i.e., 1989.

Payroll Year

Enter the year for which you are running W-2s. Again, the program defaults to last year.

Computer Manufacturer

This is the name of the manufacturer of the computer on which you are running this program.

Payroll Type

The government classification for the type of payroll you have. A menu supplies the possible choices.

Sender Information

The sender (or transmitter) is the name, address and Federal ID number of the organization submitting the W-2 information.

Return Information

This is the name and address to be used for any return.

Employer Information

This is where the actual employer name, address and Federal ID number are entered.

General Program Operation

When you are ready to create your W-2s, we suggest you use the standard payroll 'Print W-2s' program to start with. This will give you an opportunity to review the information in a printed format first. Be sure to not clear history information, or delete terminated employees!

This program has to have the following in order to satisfy the government requirements for diskette reporting:

City, State, Zip fields in the Payroll file -

| * | City must be the first field in the group, and it must be followed by a comma. If the comma is absent, the entire City, State, Zip field is considered to be City. |

| * | State must follow the city, and it must be the standard two letter postal abbreviation. |

| * | Zip must follow state with at least one space in between. Only five number zip codes are recognized. |

Examples:

Valid Bellevue, WA 98007

Bellevue,wa 98007

Invalid Bellevue WA 98007 (no comma after city)

Bellevue, WA98007 (no space after state)

Dallas, Texas 75714 (state must be TX)

Social Security Numbers in the Payroll File -

| * | Each employee's social security number must be left justified. |

| * | The only delimiters (separator characters) allowed are the dash (-), space, or nothing. These three cannot be intermixed in one social security number. |

Examples:

Valid Invalid

123-45-6789 123/45/6789 (no slashes allowed)

123 45 6789 123-45 6789 (mixing delimiters)

123456789 12345-6789 (mixing delimiters)

All addresses must be domestic only. No foreign postal codes are supported.

If the above conditions are not met, or if you are not sure, use PR-A, Enter/Change Employees, to correct the address/social security number information for a particular employee.

Creating the Output

When you are finished entering all options, the program will proceed to create the W-2s. It will display the name of each employee it is working on so you can track the progress.

After the W-2s are created, the program will ask if you want to delete the terminated employees. If you enter Y, the program will check the file for any terminated employees and remove them. The program also asks if you wish to clear the year's payroll data. DO NOT DO THIS IF YOU HAVEN'T ALREADY PRINTED PAPER W-2S.

Refer to the Print W-2s portion of the Payroll section documentation for more information.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?spr_d_w_2diskettereporting.htm