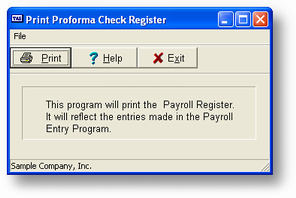

Purpose of Program

Use this program to print the payroll register. You should run this program after entering payroll information in PR-B, Enter Pay Info and before you run PR-D, Print Payroll Checks. This program allows you to check your payroll information to see if you need to make any changes to the entries before payroll checks are printed. This report will include all of the payroll information for each employee for the current pay period, and totals for all employees. A sample report is provided in Appendix F.

General Program Operation

This program has no entry routines other than the standard printing options.

Fields explained

FICA-OASDI (Federal Insurance Contribution Act)

FICA-OASDI and FICA-Medicare are mandatory taxes based on the Federal Insurance Contribution Act. All employees, except for students enrolled in at least half-time status, and certain Non-resident Aliens, must pay these taxes. FICA taxes are based on a flat percentage of your taxable income. There is a yearly limit for FICA-OASDI; there is not a yearly limit for FICA-Medicare.

After the printing is complete, the program will return you to the main menu.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?pr_c_printpayrollregister.htm