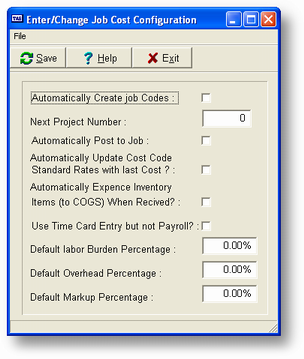

Purpose of Program

Use this program to enter controlling information that will affect Job Cost only.

General Program Operation

Automatically Create Job Codes

If you enter Y here, the program will automatically create job codes when entering new estimates. That is, if you don't enter a value when the cursor is in the Project Code field, the program will create a code for you. The format of the standard job code is YY-NNNN where YY is the year, e.g., 93 and NNNN is the next project number filled with zeros, e.g., 0020.

Next Project Number

This is the number that will be used in creating a new job code if you answer Y to Automatically Create Job Codes above. We recommend that you reset this number each year so that you can use it as a simple method of keeping track of the number of jobs per year. With the year being the first 2 characters of the job code you won't have to worry about reusing old numbers.

Automatically Post to Job

If you enter Y here, and are using the "integrated" approach, the program will automatically post all transactions entered to the appropriate job. If you enter N, the program will post to all other appropriate accounts but not the job record. You will have to post to the job by choosing the posting routine in JC-C - Transactions.

Automatically update cost code...

If you enter Y here, the program will automatically update the default rate values in the cost code record if you enter an amount different from what is already there. If you don't want those rates to change unless you change them in JC-D, Cost Codes, then enter N here.

Automatically expense inventory items...

If you enter Y here, the program will automatically expense any inventory items received directly to the Cost of Goods Sold account upon receipt. Normally the program would place these items in inventory and not expense them until they were included on a sales order/invoice. The cost, in either case, is posted to the job as appropriate. This will only affect the general accounting.

Use Time Card entry but not Payroll

If you are using the "stand-alone" approach, but still want to make time card entries, then enter Y here. You will not specify individual employees but you may make as many time card entries as desired. When you are finished entering, the program will ask if you wish to post the entries to the appropriate jobs. If you are using the "integrated" approach and are running Payroll then enter N here.

Default Labor Burden Percentage

This is the rate that will be displayed as the default when entering an estimate/change order. This percentage is multiplied by the direct labor cost and added to the total cost figure that is used when calculating the sale price for the job. This generally takes into consideration costs of employees not paid by the employee, e.g., health insurance, taxes paid by employer, and so on. This is not considered a normal part of overhead.

Default Overhead Percentage

This is the rate that will be displayed as the default when entering an estimate/change order. This percentage is multiplied by all direct costs to get an estimate of the indirect cost involved with doing any job. This would include management expense, rent of general office space, utilities for that space, and so forth.

Default Markup Percentage

This is the rate that will be displayed as the default when entering an estimate/change order. This is multiplied by all costs to get a price for the job.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?jc_f_jcmsconfigurationinfo.htm