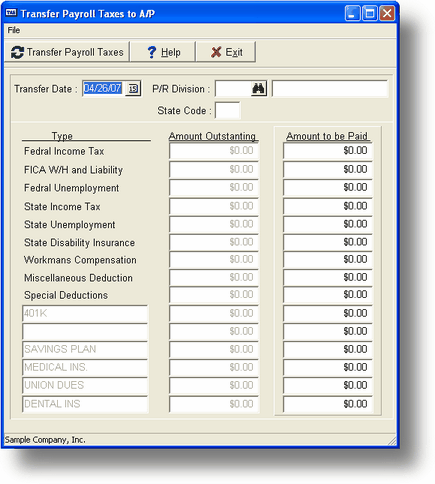

Use this program to transfer the payroll taxes held in the payroll Liability accounts to Accounts Payable. The amounts transferred will then be available to be selected for payment by A/P check. These amounts include all of the Liability accounts set up in SY-D, Enter/Chg PR/GL Interface including:

· Federal Income Tax

· FICA withholding

· SDI

· Miscellaneous Deductions

The outstanding withholding amounts are updated every time paychecks are printed, and with every transfer. You may choose which amounts and what portion of the amount to transfer.

Before running this program, you must have specified the Accounts Payable account in SY-A-A, Enter/Change Company/Interface, you must have specified the payroll liability accounts in SY-D, Enter/Chg PR/GL Interface and you must have entered appropriate vendors for your payroll withholding in AP-A, Enter/Change Vendors. See Getting Started for more information on these issues.

Field Descriptions

Transfer date:

This is the posting date for this transaction.

P/R Division:

If you are using multiple payroll divisions (originally set up in SY-D, Enter/Change PR/GL Interface), you must run this program separately for each division.

State Code:

The state code associated with the selected division is displayed.

General Program Operation

Identify the payroll division you want by typing in the division, selecting from the list display (F2) or using the standard record search keys.

If there are no outstanding amounts to transfer, a message to that effect is displayed and you are returned to the main menu.

If there are amounts to transfer, the cursor is placed in the Amt to be Paid column, opposite the first Amt Outstanding amount. The entire outstanding amount is offered as a default. You can press ENTER to record the default amount for transfer, or type in an amount to transfer and then press ENTER. Repeat this operation for each amount you want transferred.

When you have recorded the amounts you want transferred, press F10 to save your choices. The amounts are automatically transferred to Accounts Payable, against the vendor accounts you defined when setting up (see Getting Started).

You do not need to transfer all amounts; you can press F10 at any time to save and transfer only the amounts you want. When you transfer payroll taxes, the next A/P invoice number is updated, appropriate invoice line items are added to the A/P Transaction file, the outstanding amounts in the vendor record are updated, the transaction is posted to the General Ledger and the Payroll Journal, and the outstanding taxes in Enter/Chg PR/GL Interface (SY-D) are updated.

Once the amounts are transferred, the program returns you to the main menu.

Remember that you must run this program separately for each payroll division.

Page url: http://www.cassoftware.com.com/adv7docs/index.html?pr_m_transferpayrolltaxes.htm